Section 194N - TDS on Cash Withdrawal

CA Anand Singh | 29-Aug-2022

Section 194N - TDS on Cash Withdrawal

When is TDS deducted on cash withdrawal u/s 194N?

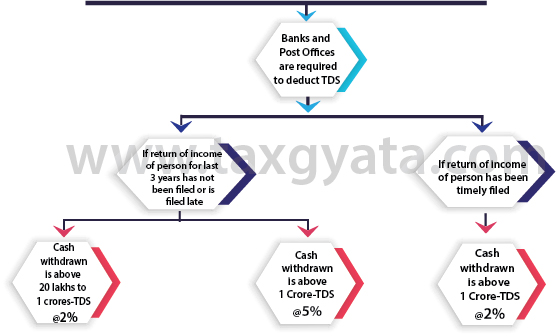

According to section 194N of the Act, TDS has to be deducted if a sum or aggregate of sum withdrawn in cash by a person in a particular FY exceeds :

- Rs 20 lakh (if no ITR has been filed for all the three previous AYs), or

- Rs 1 crore (if ITRs have been filed for all or any one of three previous AYs).

Who is required to deduct TDS u/s 194N?

The following person (payer) making the cash payment will have to deduct TDS under Section 194N:

- Any bank (private or public sector)

- A co-operative bank

- A post office

But it shall not apply if the withdrawals are made by the following persons:

- Central or state government

- Private or public sector bank

- Any cooperative bank Post office

- Business correspondent of any bank

- White label ATM operator of any bank

- Central government specified commission agents or traders operating under Agriculture Produce Market Committee (APMC) for making payment to the farmers on account of purchase of agriculture produce

- Authorized dealers and its franchise agent and sub-agent and Full-Fledged Money Changer (FFMC) licensed by RBI and its franchise agents

- Any other person notified by the Government in consultation with RBI.

Time of TDS deduction under Section 194N

The payer should deduct TDS while making the cash payment over and above Rs 1 crore in a financial year to the payee.

If the payee withdraws a sum of money at regular intervals, the payer will have to deduct TDS from the amount once the total sum withdrawn exceeds Rs 1 crore in a financial year. For example, if a person withdraws Rs 99 lakh in aggregate in the financial year and the next time, an amount of Rs 2,00,000 is withdrawn, the TDS liability is only on the excess amount of Rs 1,00,000.

TDS rate under Section 194N

1. TDS will be deducted at a rate of 2% on cash withdrawals in excess of Rs 1 crore if the person withdrawing the cash has filed income tax return for any or all three previous AYs.

2. TDS will be deducted at 2% on cash withdrawals of more than Rs 20 lakh and 5% for withdrawals exceeding Rs 1 crore if the person withdrawing the cash has not filed ITR for any of the preceding three AYs.

illustration

1. In a case in which an individual 'XYZ' has a savings account and a current account in a Bank. During FY 2020- 21, he withdraws cash of Rs 50 lakhs from savings account on 31.12.2020 and Rs 60 lakhs from current account on 28.2.2021, what will be the amount of TDS by the bank in FY 20-21 u/s 194N. Mr XYZ is regularly filing his ITR in time for last 10 years.

| Total cash withdrawal in FY 20-21 by Mr XYZ from a bank | Rs 1,10,00,000 |

| Sum exceeding Rs 1 crore | Rs 10,00,000 |

| Rate of TDS | 2% |

| Total TDS to be deducted by the bank | Rs 20,000 |