Job work under GST

CA Anand Singh | 02-May-2022

Job work under GST

Meaning of Job Work

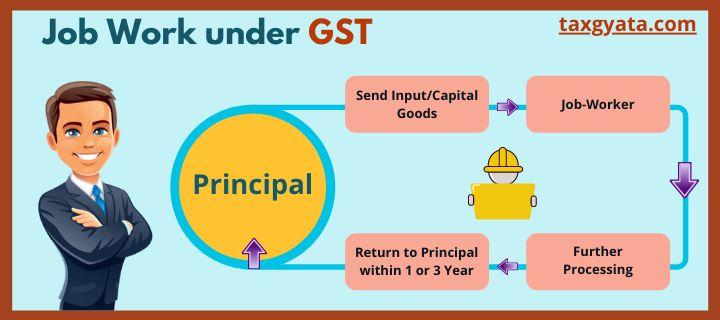

The term Job-work itself explains the meaning. It is the processing of goods supplied by the principal manufacturer to the job worker. The person who sent the goods for job work is called the principal and the one who does the said job is known as ‘job worker.

As per section 2(68) of the CGST Act 2017, "job work" means any treatment or process undertaken by a person on goods belonging to another registered person. Eg.- Packing, Fitting, etc.

Accordingly, for treating anything as job work under GST there must be: -

- Two persons;

- The goods should belong to another registered person;

- Process to be undertaken on the said goods shall be by the job worker, whether registered or not.

Registration requirement for job workers under GST

A job worker is required to get registered under GST if his aggregate turnover in a financial year exceeds the applicable threshold limit (i.e. Rs 10 lakh in Special Category States or Rs 20 lakh in case of other States).

Further, it is clarified that supply of goods by the principal from the job worker premises will be regarded as supply by the principal and not by the job worker. Therefore, while ascertaining the requirement of GST registration, value of such goods supplied will be added in the aggregate turnover of the principal and not job worker.

Job work procedure under GST

1. Sending goods from principal's premises to job worker's premises

- A principal can send input/capital goods without payment of tax to a job worker.

- Goods will be removed under intimation to the proper officer and subject to certain conditions.

- Principal is not required to reverse the input tax credit (ITC) availed on input/capital goods dispatched to job-worker.

2. Sending goods directly to job worker's premises

A principal can send inputs or capital goods directly to the job worker without bringing them to his premises. Credit of tax paid on such inputs or capital goods can be claimed.

3. Removal of goods from job worker's place

After processing of goods, the job worker may clear the goods to-

(i) Another job worker for further processing;

(ii) Dispatch the goods to any of the place of business of the principal without payment of tax;

(iii) Remove the goods on payment of tax within India or without payment of tax for export outside India on fulfillment of conditions.

Delivery challan for sending goods for job work

1. All goods shall be sent to the job worker under the cover of a delivery challan issued by the principal. Delivery challan is required even if such goods are sent directly to a job-worker.

2. Contents of delivery challan: The delivery challan should be serially numbered and shall contain the following details:

(i) date and number of the delivery challan;

(ii) name, address and GSTIN of the consigner, if registered;

(iii) name, address and GSTIN or Unique Identity Number of the consignee, if registered;

(iv) Harmonised System of Nomenclature (HSN) code and description of goods;

(v) quantity (provisional, where the exact quantity being supplied is not known);

(vi) taxable value;

(vii) tax rate and tax amount – central tax, State tax, integrated tax, Union territory tax or cess, where the transportation is for supply to the consignee;

(viii) place of supply, in case of inter-State movement; and

(ix) signature.

3. Delivery challan to be in triplicate.

4. Details of job work challans issued during a quarter must be furnished in FORM GST ITC-04..

Quarterly GST return of material sent for job work

The principal is required to file quarterly return in Form GST ITC-04 by the 25th day of the month succeeding the quarter. The said form will serve as intimation as envisaged under section 143 of the CGST Act, 2017.

Details of the following types of transactions will be furnished in GST ITC-04:

- Goods dispatched to a job worker

- Goods received from a job worker

- Goods sent from one job worker to another.

Due date for filing ITC-04 for FY 2021-22

|

Quarter |

Due date |

|

Q1 (Apr 2021 - Jun 2021) |

25th July 2021 |

|

Q2 (Jul 2021 - Sep 2021) |

25th October 2021 |

|

Q3 (Oct 2021 – Dec 2021) |

25th January 2022 |

|

Q4 (Jan 2022 - Mar 2022) |

25th April 2022 |

Input tax credit (ITC) in respect of goods sent to job worker

Section 19 of GST provides that the principal is entitled to take the credit of tax paid on inputs sent to the job- worker for the job work. Further, the principal is allowed to claim the credit even when the goods have been directly sent to the job worker from supplier's place.

Time limit for return of goods sent for job work under GST

(i) Inputs sent for job work must be returned/supplied from job worker's premises within 1 year.

(ii) Capital goods sent for job work must be returned/supplied from job worker's premises within 3 years.

In case of non compliance with the timelines,

- The goods will be deemed to have been supplied (sold) to the job worker on the day they were sent out.

- A principal is liable to pay tax along with interest on such supply.

- Return after the expiry of the time limit will be treated as a separate supply.

illustration

A notebook supplier sends the raw paper to ABC enterprises (job-worker) on 15th March 2022 for making the notebooks as per dimensions and design are given by him. ABC enterprises have not completed job work within 1 year and semi-finished paper lies in his godown.

In the instant case, as goods are not returned by job-worker within 1 year, the paper sent by notebook supplier to ABC enterprises will be deemed as supply and, the tax would be payable on the same.

Whether an E-way bill is required for sending material to a job worker?

E-way bill is generated online by the registered person or transporter which is required to be carried by the transporter if the value of goods exceeds Rs 50000.

In case of goods are sent for job work under GST,

- Eway bill is required to be generated if goods are sent to a job worker in another state even the value of the consignment is less than Rs 50,000.

- Where goods are being transported on a delivery challan in lieu of invoice, the same shall be declared in the e-way bill.

- E-way bill can be generated either by the Principal or job worker

- If the job worker is unregistered, an e-way bill should be generated by the Principal.

Treatment of waste and scrap arising during job work under GST

As per section 143 (5) of the CGST Act, 2017, waste generated at the premises of the job worker may be supplied directly by the registered job worker from his place of business on payment of tax or such waste may be cleared by the principal, in case the job worker is not registered.

|

Situation |

Person liable to pay tax |

|

Waste and scrap supplied directly by the registered job worker from his place of business |

Job worker |

|

Waste and scrap supplied by the principal |

Principal |

Who is responsible for the maintenance of accounts and records related to job work under GST?

The principal shall be responsible to keep proper accounts for the inputs or capital goods or waste/scrap lying with the job worker.

GST rate for job work services

|

Description |

GST Rate |

|

Services by way of job work in relation to- (a) printing of newspapers (b) textiles and textile products falling under Chapters 50 to 63 in the First Schedule to the Customs Tariff Act, 1975 (51of 1975) (c) all products, other than diamonds, falling under Chapter 71 in the First Schedule to the Customs Tariff Act, 1975 (51of 1975) (d) printing of books (including Braille books), journals and periodicals (e) printing of all goods falling under Chapter 48 or 49, which attract IGST @ 5 per cent or Nil (f) processing of hides, skins and leather falling under Chapter 41 in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) (g) manufacture of leather goods or footwear falling under Chapter 42 or 64 in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) respectively (h) all food and food products falling under Chapters 1 to 22 in the First Schedule to the Customs Tariff Act, 1975 (51of 1975) (i) all products falling under Chapter 23 in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), except dog and cat food put up for retail sale falling under tariff item 2309 10 00 of the said chapter (j) manufacture of clay bricks falling under tariff item 6901 00 10 in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) (k) manufacture of handicraft goods |

5% |

|

Services by way of job work in relation to- (a) manufacture of umbrella (b) printing of all goods falling under Chapter 48 or 49, which attract IGST @ 12 per cent |

12% |

|

Services by way of job work in relation to bus body building |

18% |

|

Services by way of any treatment or process on goods belonging to another person, in relation to- (a) printing of newspapers (b) printing of books (including Braille books), journals and periodicals (c) printing of all goods falling under Chapter 48 or 49, which attract IGST @ 5 per cent or Nil |

5% |

|

Services by way of any treatment or process on goods belonging to another person, in relation to printing of all goods falling under Chapter 48 or 49, which attract IGST @ 12 per cent |

12% |

|

Other job work services not specified elsewhere |

18% |